Jun 10, · This over view is devoted to two reversal patterns from candlestick analysis: the Hanging Man and Inverted Hammer. When they appear on the chart, this means a correction or a Inverted Hammer Forex Trading Strategy This is a price action trading strategy called the inverted hammer forex trading strategy and it is based on a candlestick pattern called the inverted blogger.comted Reading Time: 3 mins A hammer after an uptrend is called a hanging man. An inverted hammer after an uptrend is called a shooting star. Hammer Inverted Hammer OR OR OR OR Why are Hammers important?

Bullish Inverted Hammer Candlestick Pattern - Forex Education

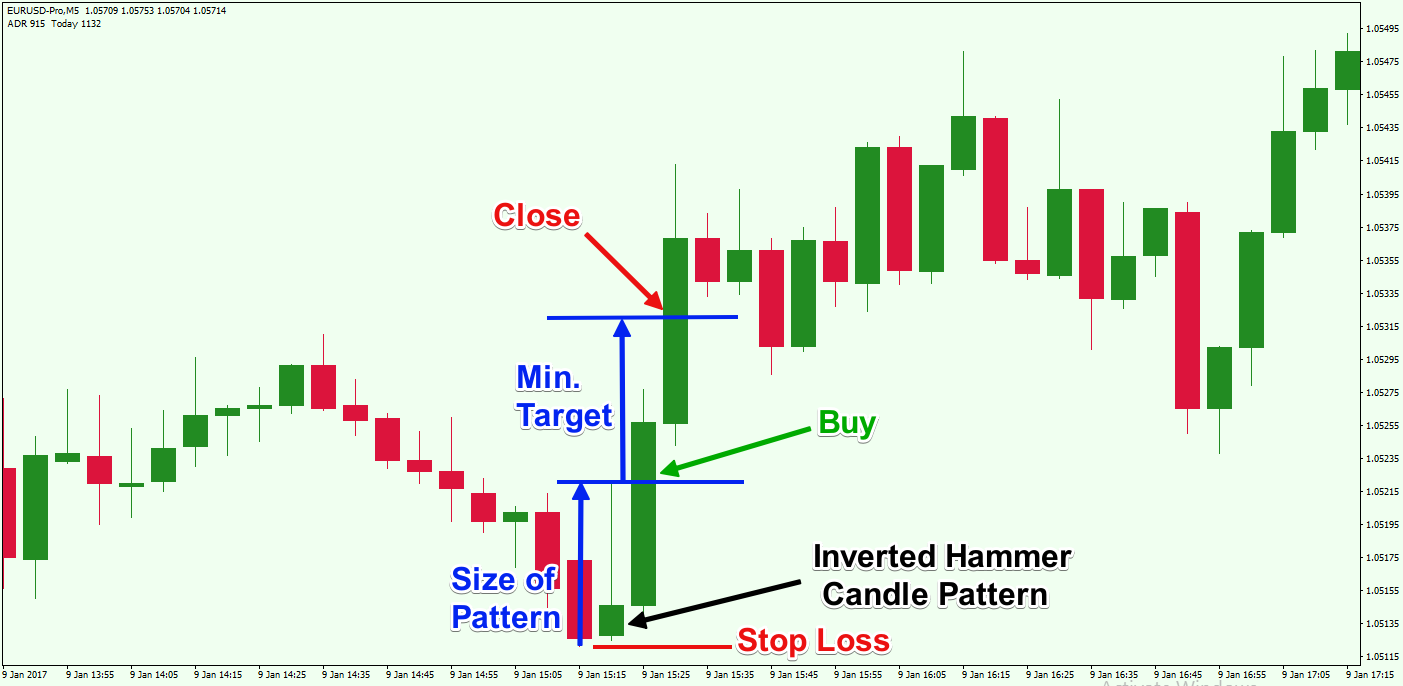

Interested in trading commodities? The Inverted Hammer candlestick formation occurs mainly at the bottom of downtrends and can act as a warning of a potential bullish reversal pattern. What happens on the next day after the Inverted Hammer pattern is what gives traders an idea as to whether or not prices will go higher or lower.

The Inverted Hammer formation is created when the open, low, inverted hammer forex, and close are roughly the same price. Also, there is a long upper shadow which should be at least twice the length of the real body.

After a long downtrend, the formation of an Inverted Hammer is bullish because prices hesitated to move downward during the day. Sellers pushed prices back to where they were at the open, but increasing prices shows that bulls are testing the power of the bears.

When the low and the open are the same, a bullish, green Inverted Hammer candlestick is formed and it is considered a stronger bullish sign than when the low and close are the same a red Inverted Hammer. Chart 2 shows that the market began the day by gapping down. Prices moved higher until resistance and supply were found at the high of the day.

To some traders, this confirmation candle, plus the fact that the downward trendline resistance was broken, gave them a potential signal to go inverted hammer forex. It is important to note that the Inverted pattern is a warning of potential price change, not a signal, by itself, to buy.

Other indicators such as a trendline break or confirmation candle should be used to generate a potential buy signal.

The bearish version of the Inverted Hammer is the Shooting Star formation that occurs after an uptrend. Start your research with reviews of these regulated brokers available in. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage, inverted hammer forex. Although in isolation, the Shooting Star formation looks exactly like the Inverted Hammer, their placement in time is quite different. The main difference between the two patterns is that the Shooting Star occurs at the top of an uptrend bearish reversal pattern and the Inverted Hammer occurs at the bottom of a downtrend bullish reversal pattern.

Learn more about technical analysis indicatorsinverted hammer forex, concepts, and strategies including:. We hate spam - see our privacy policy. Skip to content. Disclosure: Your support helps keep Commodity.

com running! Learn more Contents What Is the Inverted Hammer Candlestick? What Does the Inverted Hammer Look Like? What Does the Inverted Candlestick Hammer Mean? Where Can I Trade? Inverted hammer forex Further Reading. Chart 1, inverted hammer forex. Chart 2. Loading table Get The Commodity. com Newsletter Get daily updates on commodity markets.

Sign me up right now! com Daily Newsletter. Get the latest market intelligence from the world of inverted hammer forex. Let's Go, inverted hammer forex. Plus is not available in the US Legitimate CFD brokers, like Plus, cannot accept US clients by law.

How to Use Inverted hammer candlesticks - Free Technical analysis for Forex Trading

, time: 8:55The Inverted Hammer and its Reliability in Currency Charts

Jun 10, · This over view is devoted to two reversal patterns from candlestick analysis: the Hanging Man and Inverted Hammer. When they appear on the chart, this means a correction or a Inverted Hammer Forex Trading Strategy This is a price action trading strategy called the inverted hammer forex trading strategy and it is based on a candlestick pattern called the inverted blogger.comted Reading Time: 3 mins Mar 12, · Inverted Hammer An Inverted Hammer is a single Japenese candlestick pattern. It is a bullish reversal pattern. In a downtrend, the open is lower, then Estimated Reading Time: 2 mins

No comments:

Post a Comment