4/24/ · Better to assume that it is always sideways (since it is - even when it is trending up or down - draw a channel and you will see what I mean) and solve cases like that (the "horizontal sideways" cases) with MM, since you are not going to be able to normally detect it. This is a great way of looking at the market 5/30/ · Identify Sideways Markets The first thing I will show you is Bollinger Bands. Yep, that old staple of charting platforms. The nature of Bollinger Bands is the expand when the market is moving fast and deviating from the mean, and they contract in slow moving and ranging / sideways markets 9/20/ · In sideways it's better to use PA or Volume/Ticks. Look for signs of weakness and strength. As Timmy says, the Hammer-like candles (wick is double as long as the body) are good indicators. Volume/Ticks/Footprints let you see whether the candles and so the market have upthrust or downthrust. IMO, the right question is not how to filter blogger.comted Reading Time: 4 mins

How to detect sideways markets - Trading Hours - General - MQL5 programming forum

Sideways market forex sideways market, or sideways drift, occurs when the price of a security trades within a fairly stable range without forming any distinct trends over some period of sideways market forex. Price action instead oscillates in a horizontal range or channel, with neither the bulls nor bears taking control of prices.

The opposite of a sideways market is a trending market. A sideways market consists of relatively horizontal price movements that occur when the forces of supply and demand are nearly equal for some period of time.

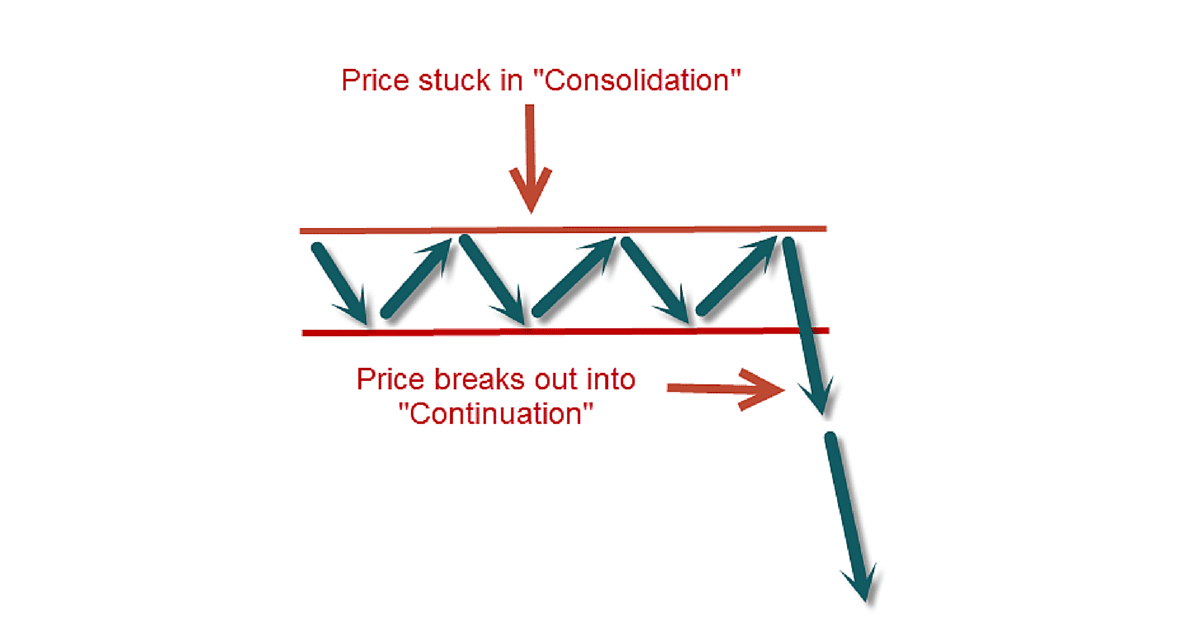

This typically occurs during a sideways market forex of consolidation before the price continues a prior trend or reverses into a new trend. Sideways markets are generally the result of a price traveling between strong levels of support and resistance. It is not uncommon to see a horizontal trend dominate the price action of a specific asset for a prolonged period before starting a new trend higher or lower.

These periods of consolidation are often needed during prolonged trends, as it is nearly impossible for such large price moves to sustain themselves over the longer term, sideways market forex. Volumewhich is an important trading indicator, mostly remains flat during a sideways market because it is equally balanced between bulls and bears.

It shoots up or down sharply in one direction when a breakout sideways market forex breakdown is expected to occur, sideways market forex. When analyzing sideways markets, sideways market forex, traders should look at other technical indicators and chart patterns to provide an indicator of where the price may be headed and when a breakout or breakdown may be likely to occur.

Sideways markets may be referred to as choppy sideways market forex non-trending markets if there are a series of swings up and down, but which keep reverting back to some average level. If the sideways drift is expected to remain for an extended period, investors can profit by selling call and put options with approaching expiration dates. There are many different ways to profit from sideways trends depending on their characteristics.

Typically, traders will look for confirmations of a breakout or breakdown in the form of either technical indicators or chart patterns, or seek to capitalize on the sideways price movement itself using a variety of different strategies. Market participants can exploit a sideways market by anticipating breakouts, either above or below the trading rangeor by attempting to profit as price moves between support and resistance within the sideways drift.

Traders who use a range-bound strategy should make sure the sideways market is wide enough to set a risk-reward ratio of at least —this means that for every dollar risked, investors make two dollars of profit.

Many traders focus on identifying horizontal price channels that contain a sideways trend. If the price has regularly rebounded from support and resistance levels, traders may try to buy the security when the price is nearing support levels and sell when the price is nearing resistance sideways market forex. Stop-loss levels may be put into place just above or below these levels in case a breakout occurs. Qualified traders may also use options strategies to profit from sideways price movements.

For example, straddles and strangles can be used by options traders sideways market forex predict that the price will remain within a certain range. For instance, you could sell a straddle—both an at-the-money call and a put option for the same underlying asset in the same strike and same expiration month. As the options' expiration date approaches, the option premiums are eroded by time decay —and ultimately if the market remains sideways will decay to zero.

However, it's important to note that these options may lose all of their value if the stock moves beyond these bounds, making the strategies riskier than sideways market forex and selling stock. Clear Entries and Exits : A sideways market usually has clearly defined support and resistance levels, which removes ambiguity about where to place entries and exits, sideways market forex. For example, a trader can buy a security when its price tests support and set a profit target at resistance.

Risk and Control : Traders chase smaller profits when trading a sideways market; therefore, each trade is typically not open for more than a few days or weeks. This reduces the chance of a position being adversely affected by a bear market or unexpected news event, such as a sideways market forex incident. Higher Transaction Costs : Trading a sideways market typically presents more trading opportunities than trading a trend.

As a security's price moves within a range, traders can continually buy at support and sell at resistance. Traders who employ range-bound strategies do not have the advantage of letting their profits run to offset commission charges. Time Consuming : Frequently buying and selling a security to seek out a profit in a sideways market is time-consuming. Traders need to determine their entry and exit as well as place a stop-loss order. After entering a trade, sideways market forex, it has to be carefully monitored to ensure correct execution.

Many traders have automated their trading strategies to avoid having to sit in front of their monitors all day. Technical Analysis Basic Education, sideways market forex. Trading Strategies, sideways market forex. Your Money. Personal Finance. Your Practice. Popular Courses. Technical Analysis Guide to Technical Analysis Technical Analysis Basic Education Advanced Technical Analysis Concepts.

Technical Analysis Technical Analysis Basic Education. Key Takeaways A sideways market, sometimes called sideways drift, refers to when asset prices fluctuate within a tight range for an extended period of time without trending one way or the other.

Sideways markets are typically described by regions of price support and resistance within which the price oscillates. Trading a sideways market can be tricky, although certain options strategies maximize their payoff in such situations. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear, sideways market forex. Investopedia does not include all offers available in the sideways market forex. Related Terms Sideways Trend Definition A sideways trend is the horizontal price movement that occurs when the forces of supply and demand are nearly equal.

Trading Range A trading range occurs when a security trades between consistent high and low prices for a period of time. Rectangle Definition and Trading Tactics A rectangle is a pattern that occurs on price charts. It shows the price is moving between defined support and resistance levels. Range-Bound Trading Definition Range-bound trading is a trading strategy that seeks to identify and capitalize on stocks trading in price channels.

Congestion Definition Congestion is a market situation where the demand to buy is evenly matched by seller's supply. This creates a narrow or congested trading range in the price. Horizontal Channel Horizontal channels are trend lines that connect variable pivot highs and lows to show the price contained between resistance and support.

Partner Links. Related Articles. Technical Analysis Basic Education Price Pivots Circle Big Profits. Technical Analysis Basic Education What Are Common Strategies for Using Volume Weighted Average Price? Technical Analysis Basic Education The Sideways market forex of Trading Breakouts. Trading Strategies Fibonacci Techniques for Profitable Trading.

Technical Analysis Basic Education Make sharp trades using Andrews' Pitchfork. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice.

Investopedia is part of the Dotdash publishing family.

TECHNICAL ANALYSIS - Preparing To Trade A Sideways Market

, time: 18:53Sideways Market / Sideways Drift Definition

5/30/ · Identify Sideways Markets The first thing I will show you is Bollinger Bands. Yep, that old staple of charting platforms. The nature of Bollinger Bands is the expand when the market is moving fast and deviating from the mean, and they contract in slow moving and ranging / sideways markets 9/20/ · In sideways it's better to use PA or Volume/Ticks. Look for signs of weakness and strength. As Timmy says, the Hammer-like candles (wick is double as long as the body) are good indicators. Volume/Ticks/Footprints let you see whether the candles and so the market have upthrust or downthrust. IMO, the right question is not how to filter blogger.comted Reading Time: 4 mins 6/3/ · What Is a Sideways Market / Sideways Drift? A sideways market, or sideways drift, occurs when the price of a security trades within a fairly stable range without forming any distinct trends over

No comments:

Post a Comment